Stamp Duty Calculator

2016 Stamp Duty Calculators

To calculate the current stamp, simply enter the purchase price and click calculate.

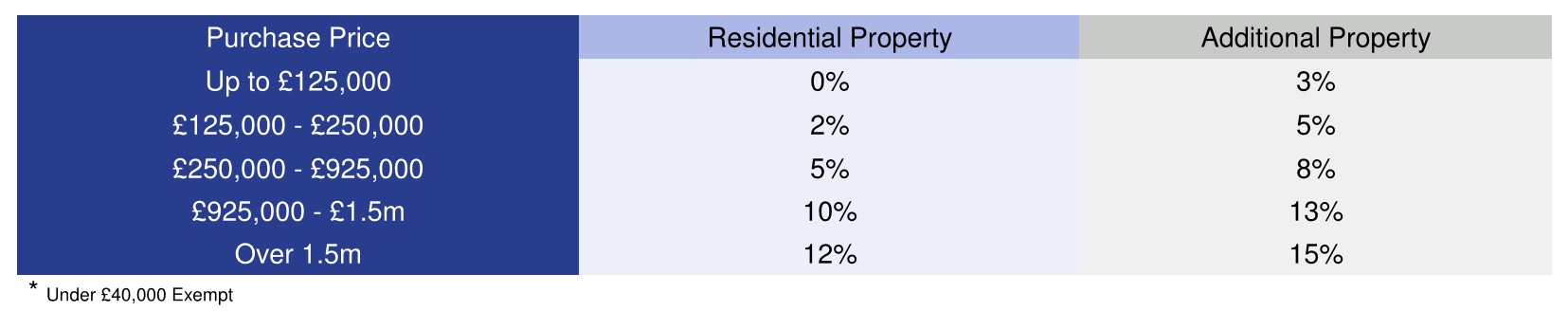

As of the 1st April 2016, people purchasing second homes or buy to let properties will have to pay a 3% surcharge on each stamp duty band. That means that for properties worth between £125,000 and £250,000, where the stamp duty is 2%, those buying a second home or buy-to-let property will pay 5%, and for properties worth more than £250,000 and up to £925,000, where the stamp duty is 5%, those buying second home or buy-to-let property will pay 8%.

The current stamp duty rates in England, Wales and Northern Ireland are shown in the table below:

The most common scenario where the higher rate will be charged is where there is a purchase of a buy to let or second home in addition to a main residence which completes after 1st April 2016. An exception to this will be where the property being purchased is replacing the individual’s main residence. Where the sale of a main residence has not completed at the time of the purchase then the higher rate will apply although a refund of the additional SDLT can be claimed as long as the main residence is sold within 18 months.